The Gift That Keeps On Giving

October 15, 2020

The Power of GRATITUDE

November 24, 2020A Goal Without a Plan Is Just a Wish

Attractive young man in a suit with his fingers crossed wishing for good luck in a studio

A Goal Without a Plan Is Just a Wish

As 2020 draws to a close, how confident are you of exceeding your sales (growth) targets this year?

Will you be celebrating or commiserating at year end?

In a year that has caused us to feel uncertain, frustrated and exhausted …. wouldn’t it be great to celebrate some success.

Sadly, the majority of bankers and salespeople will fail to exceed their goals this year.

And that’s not because of the pandemic. In this year of chaos, there has certainly been lots of opportunity.

It’s because of a failure to develop/implement a business development activity plan and because of a lack of regular training.

The LA Dodgers & Lakers just celebrated winning championships.

Many athletes wish, dream and pray of winning a championship … but only those athletes that diligently follow a well constructed game plan and commit to regular coaching will achieve this goal.

So why should it be any different in banking or sales?

Stop wishing that each year will be better than the last.

Stop praying for success.

You can control your results by developing an activity plan and implementing a coaching cadence.

Here is a simple approach I implemented throughout my career to consistently achieve my goals year after year.

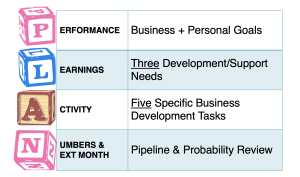

1. Develop an Activity PLAN

Throughout my 30 year career, I have developed individual monthly Activity PLANs with my teams to help them achieve their business AND personal goals.

In fact, when I started my professional coaching business 5 years ago, I developed a monthly Activity PLAN and I have consistently exceeded my annual goals every year …. including this year.

I encourage you to meet with your leader, or a mentor, to agree and periodically review the following:

1. PERFORMANCE

Key performance metrics (goals) to help you measure success.

Examples: Sales Target, Loan Growth, Deposit Growth, New Clients

2. LEARNINGS

Three areas of development/support that will help you with your business development efforts. Coachable skills that will help you better execute the specific business development activities (see #3 below).

Examples: Prospecting Skills, Questioning Skills, Closing Skills, Marketing Support

3. ACTIVITIES

Five specific business development activities that are critical for achieving your performance goals. Consider both quantity and quality of activity to ensure you can prioritize and focus your efforts.

Examples: 5 Existing Client Meetings, 4 Prospect Meetings, 4 Events, 5 Referrer Meetings

4. NUMBERS / NEXT MONTH

Pipeline report to determine the probability of achieving your performance goals next month.

To be clear, this is NOT a basic “call program”. It is a specific PLAN designed to help you better determine the specific activities and skills you need to achieve your goals.

Once complete, the aim is to commit to the PLAN and review your performance with your leader/mentor each month.

Review what is working, what isn’t working and what support/coaching you need each month to improve your chance of success.

2. Implement a Coaching Cadence

The reason why basic “call programs” generally fail is because they are not supported by constant coaching to help bankers (and salespeople) more effectively execute the calls.

This is why I am a big fan of my P.L.A.N. approach to “calls” (or business development activity).

It incorporates LEARNINGS that are designed to help the banker (sales person) achieve their goals more effectively.

Leaders need to STOP simply setting goals and assuming that their staff are capable of achieving them without any constant coaching or support. No matter how experienced your staff. And providing only 2 – 3 formal training sessions a year will not help. So save your money.

Every elite, highly talented athlete in the world will tell you that success can only be achieved with regular training and practice.

So it should be no different in banking (and business).

Implement a simple regular coaching cadence immediately. I encourage you to schedule weekly or bi-weekly meetings with your team and incorporate skill coaching (say for 30 minutes) into your meeting agenda.

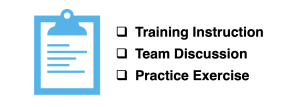

For maximum impact, your skill coaching should include the following three elements:

1. Formal training instruction/research on a specific skill facilitated by the team leader or someone who has proven success with that skill.

2. Team discussion about the training to agree on application and relevance.

3. Assignment of an exercise so each team member can practice the new ideas (skill) and share their experiences at the next team meeting.

Whether you’re a team leader or not, the implementation of a coaching cadence is critical for you to more effectively execute your new P.L.A.N. and achieve your goals.

Do you have a PLAN for 2021?

Do you participate in regular coaching?

If you expect to miss your goals in 2020 then I encourage you to STOP commiserating and START developing a PLAN to celebrate in 2021.

_________________________________________

Article written by Joe Micallef – Sales Strategist & Coach – Grow UP Sales. For more advice on how to develop an effective Sales PLAN please email joe@growupsales.com or visit the webpage www.growupsales.com

If you found the content valuable then please feel free to share this article with your broader network. Let’s help more bankers and salespeople achieve a better quality of life.